We aim to help first-time buyers onto the property ladder by providing homes for sale as part of our Low Cost Home Ownership scheme. This scheme helps first-time buyers to purchase a new home for less than the market value so that they don’t need to raise such a big mortgage or deposit.

Barry Waterfront

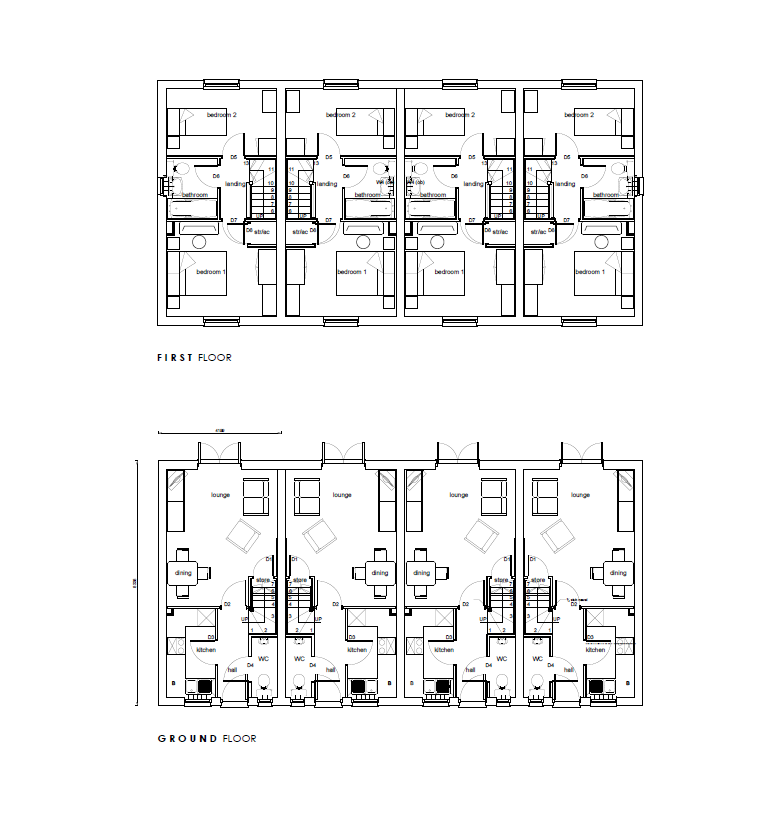

Barry Waterfront 2 x 2 bedroom houses, one mid-link and one end-link, from £160,328*Ownership: Mid-link (Reserved) – Legally you would own 100% of the property for 70% market value via the Low Cost Home Ownership scheme (*full market value £229,040, 70% equates to £160,328). End-link (Reserved) – Legally you would own 100% of the property for 70% market value via the Low Cost Home Ownership scheme (*full market value £234,040, 70% equates to £163,828). Both properties have one parking space, turfed rear gardens, and will also include a hob, oven and extractor. Estate charges are £153.92 per annum. Availability: From January 2023 |

Low Cost Ownership scheme

This scheme helps first-time buyers to purchase a new home for less than the market value so that they don’t need to raise such a big mortgage or deposit.

Who is eligible?

To be eligible applicants need to:

- Be over the age of 18

- Be a first-time buyer (consideration will also be given to those who have previously owned a property but have sold it, for example as a result of divorce)

- Be a UK or EU/EEA passport holder or have indefinite leave to remain in the UK

- Be able to raise a mortgage and be able to afford the financial costs of purchasing a property and paying a mortgage

- Use the property as your main residence

- Either be living or working in the county of the property or for those leaving the Armed Forces to have lived in the area for six months prior to joining

What sort of home can I buy?

The home that you buy from us will be brand new and usually built by a private housebuilder as part of a larger private development. We have varied purchasing opportunities at any given time, however most of the time the properties will be flats.

How does the Low Cost Home Ownership scheme work?

We will provide a loan to you, traditionally around 30% of the value of the property. You won’t need to pay any rent or interest on this but will need to repay the loan once you sell your home. You would need to raise the remaining 70% through a mortgage or any savings you may have. For example, if you wished to buy a property that was valued at £140,000, a 30% equity loan would be worth £42,000. The remaining 70% balance would be £98,000.

Once you have purchased, the equity loan will be secured on your property as a charge in favour of Hafod. Our charge will be ranked as second and immediately behind your first (conventional) mortgage if you have one.

When do I have to repay?

You can repay the charge at any time, but you only have to repay it when you sell the property on in the future. The repayment can only be made in one lump sum, i.e. you cannot pay it back in installments or make monthly payments.

How much do I have to repay?

The amount you repay is linked to the value of your property at the time of repayment. In order to establish your property’s value you will have to pay for an independent valuation to be carried out by a RICS qualified surveyor.

Once the value of your home is agreed you will then need to repay the relevant percentage (usually 30%) of that figure to us. For example, lets say that you purchased a property from Hafod for £100,000 and you received £30,000 toward the price which is equal to 30% of the purchase price.

If you wanted to repay after five years and your property was valued at £115,000 you would need to repay to Hafod £34,500 which is 30% of the new value.